Last week I stopped in at a recreational vehicle dealership to browse travel trailers. As I spoke with the salesman, he mentioned they had been having a problem for most of the year.

Last week I stopped in at a recreational vehicle dealership to browse travel trailers. As I spoke with the salesman, he mentioned they had been having a problem for most of the year.

“We can’t keep anything in stock. We sell out as soon as inventory comes in.”

A good problem to have.

By coincidence, I heard the same sentiment at a motorcycle dealership where I took my bike to be serviced and from an associate at an outdoor store about kayaks. All three gentlemen were happy to report that their wares were flying off the shelves, so to speak. It seems that the draw of the outdoors and the appeal for the vehicles that will get you there has never been greater.

I wanted to see if the anecdotes I had heard from local salespeople were part of a larger trend. Sure enough, the RV Industry Association reports that consumer interest in RVing has skyrocketed and that manufacturers are struggling to meet the unprecedented demand. August 2020 RV shipments were up a whopping 17.3% over August of 2019.

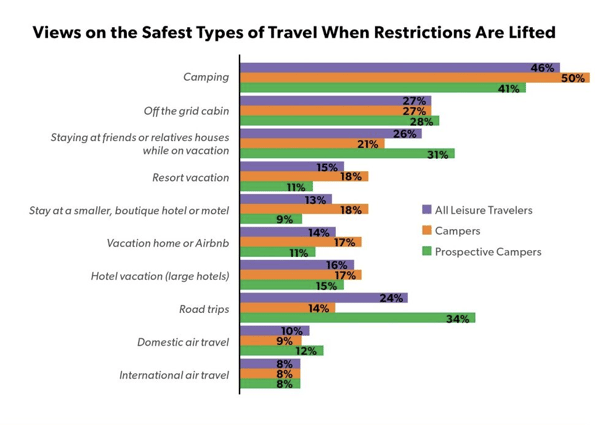

The reason behind this banner sales year for recreational vehicles of all types is not hard to guess. The safety precautions needed to combat the COVID-19 pandemic have shut down many forms of leisure, especially within cities. Getting away from it all has never seemed like a better option than it does now. In fact, a survey conducted by 'Kampgrounds of America' indicates that camping (which includes RVing) is seen as the safest type of leisure travel available.

Graphic Source: The COVID-19 edition of the North American Camping Report, created by Kampgrounds of America

Graphic Source: The COVID-19 edition of the North American Camping Report, created by Kampgrounds of America

What does all this mean for community lenders?

For one thing, it is likely good news. Community lenders often make the loans that consumers use to finance the purchase of RVs. More RVs sold means a higher loan volume.

However, this trend could bring with it some increased complexity. RV loans often carry longer-term limits and larger loan balances compared to auto loans. Additionally, travel trailers and fifth wheels aren’t the only vehicles in high demand this year. Motorcycles, ATVs, jet skis, and other “toys” are all being gobbled up by consumers looking to enjoy themselves in a socially distanced manner. That is a dizzying array of collateral being added to community lenders’ portfolios, and all of it needs to be adequately insured. A borrower may allow the insurance on a “non-essential” piece of collateral to lapse, leading to an exposure for the lender.

One way lenders can simplify their consumer lending process is by taking advantage of a blanket insurance policy. Unitas Financial Services’s Blanket Vendor Single Interest (VSI) solution is tailor made for a chaotic year like 2020. Blanket VSI eliminates the need to track and force-place insurance on a consumer portfolio, cutting out that entire task for a loan staff. Our blanket also covers all collateral types found in a consumer lending portfolio – from cars and trucks to RVs to watercraft and snowmobiles. With skip tracing services and a modified actual cash value provision built-in, plus optional endorsements such as mechanical breakdown expense and repossession storage expense, VSI is genuinely the most robust and simplest way to cover a consumer portfolio.

In a year like 2020, it is more important than ever to make sure your institution is protected. Golden Eagle’s consultative approach and 25-year track record of outstanding products and service make us the perfect partner for an unprecedented time.